The Fractal Truth of Markets 👁

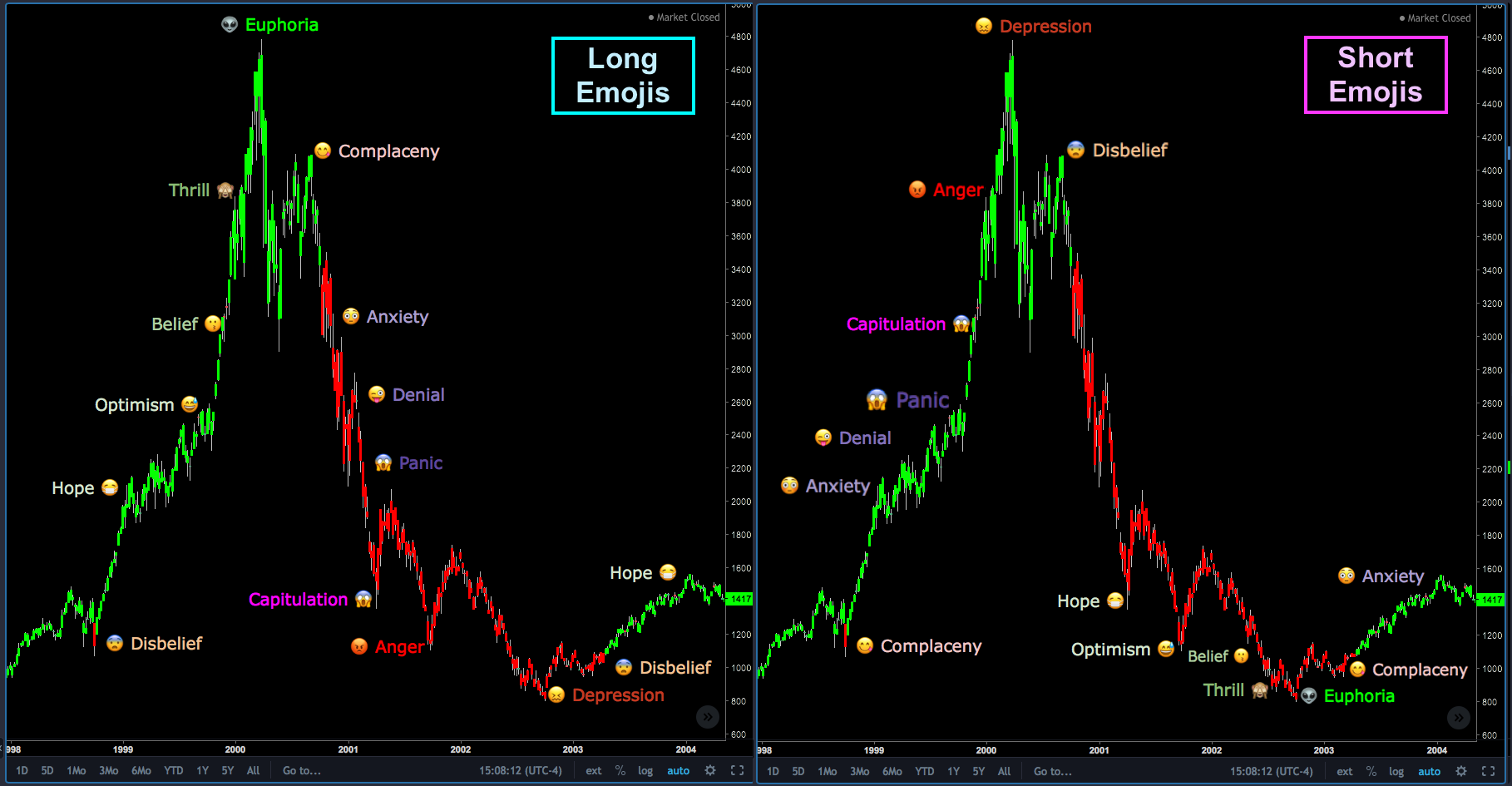

In spring of 2014 given the current condition of Bitcoin at the time we decided 2 introduced the concept of crash cycles to the crypto markets. A crash cycle pattern is a fractal pattern found in both humans & nature. In humans this emotional cycle has been observed since the days of tulip mania and all the way up to the internet bubble or dot com era most famously. I was first introduce to this concept myself by reading about the works of Brian Shannon @alphatrends back in early 2009 & he later came 2 talk technical analysis with us on Kash Cycle 2: Fundamental vs Technical Analysis . Since coming across this concept nearly a decade ago we have been able 2 refine its practical application in all asset classes .

As a professional negotiator I was given a microscope with which to study 10’s of thousands of humans & their emotional structures under one of the more difficult financial decisions one can make in their life time. I learned things I wish I didn’t to be honest about them but one thing I did learn was that their behavior was fractal in nature & all of them had the same fundamental underpinnings 2 what drives their actions & beleifs. I was able 2 create one of if not the most accurate predictive model in technical analysis based on human behavior, crash cycle formations, universal law, #ruleoftheatom (my own philosophy of value) & a few other secret ingredients. Price is nothing more than consensus behavior of human emotions over time. It is a very powerful concept when applied correctly but equally damaging if used incorrectly, examples of that can be easily seen all through out the current crash going on in crypto #LTCWinter as plebs fueled by hopium attempt 2 create rationals that keep standing in front of the train with disastrous consequences.

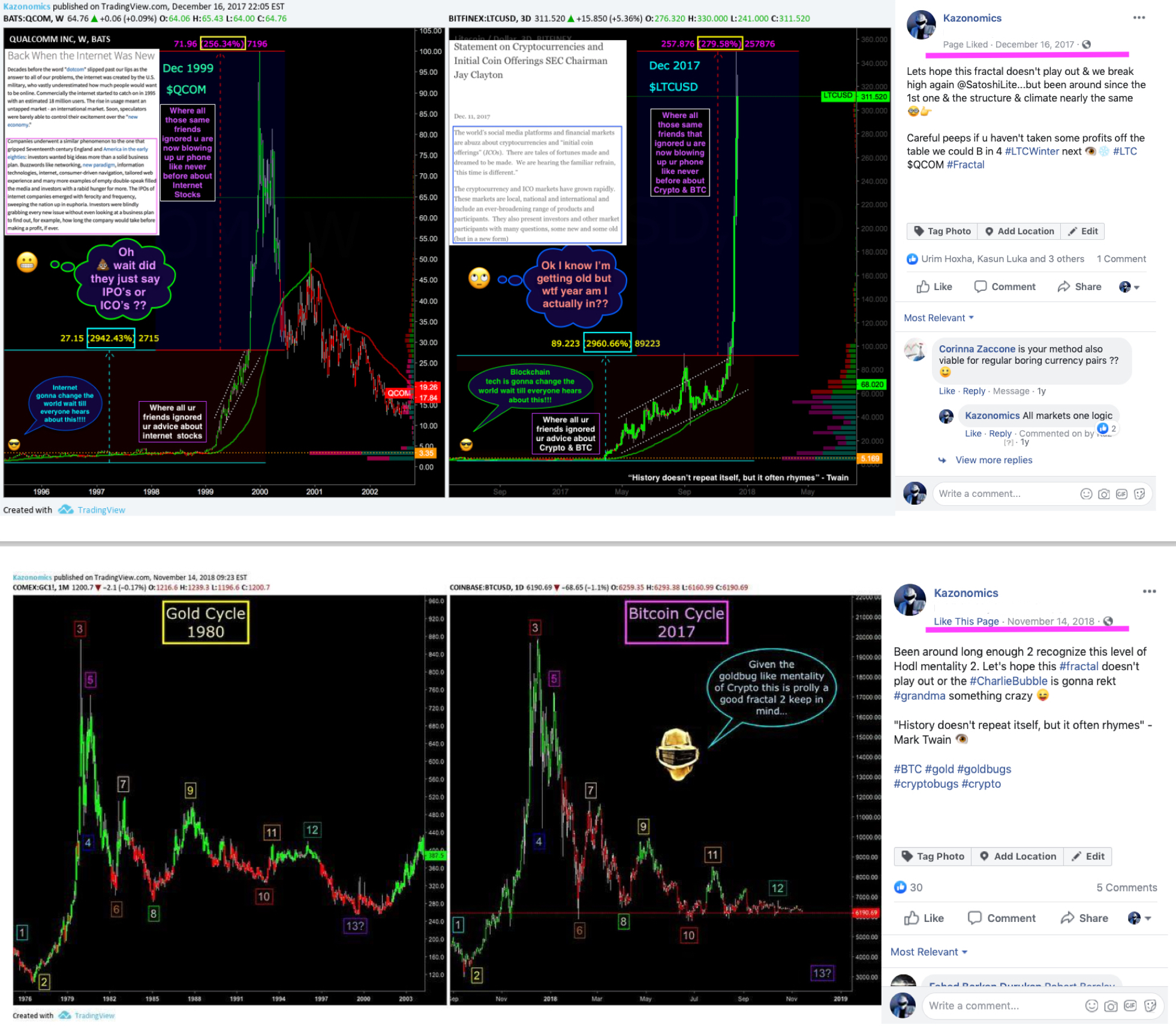

We 1st posted on this as a warning to crypto of what was likely in store for them in both Gold & Bitcoin in March 2014. At that time crypto was a very immature market with regard to technical analysis or fundamental for that matter so it was not very well received. However as time moved on it would later become a mainstay of the market. We noticed the very strong similarities between the internet bubble & Shanghai with both Gold & BTC. Bitcoin had earned an interesting place in the hearts of crypto peeps at the time and was referred 2 as “Digital Gold” & Litecoin “Digital Silver” -> 😋👉Ltc 👉🔮👉❄️👉😁 yah omg don’t even get me started lol….nvm too late 😂😂😂

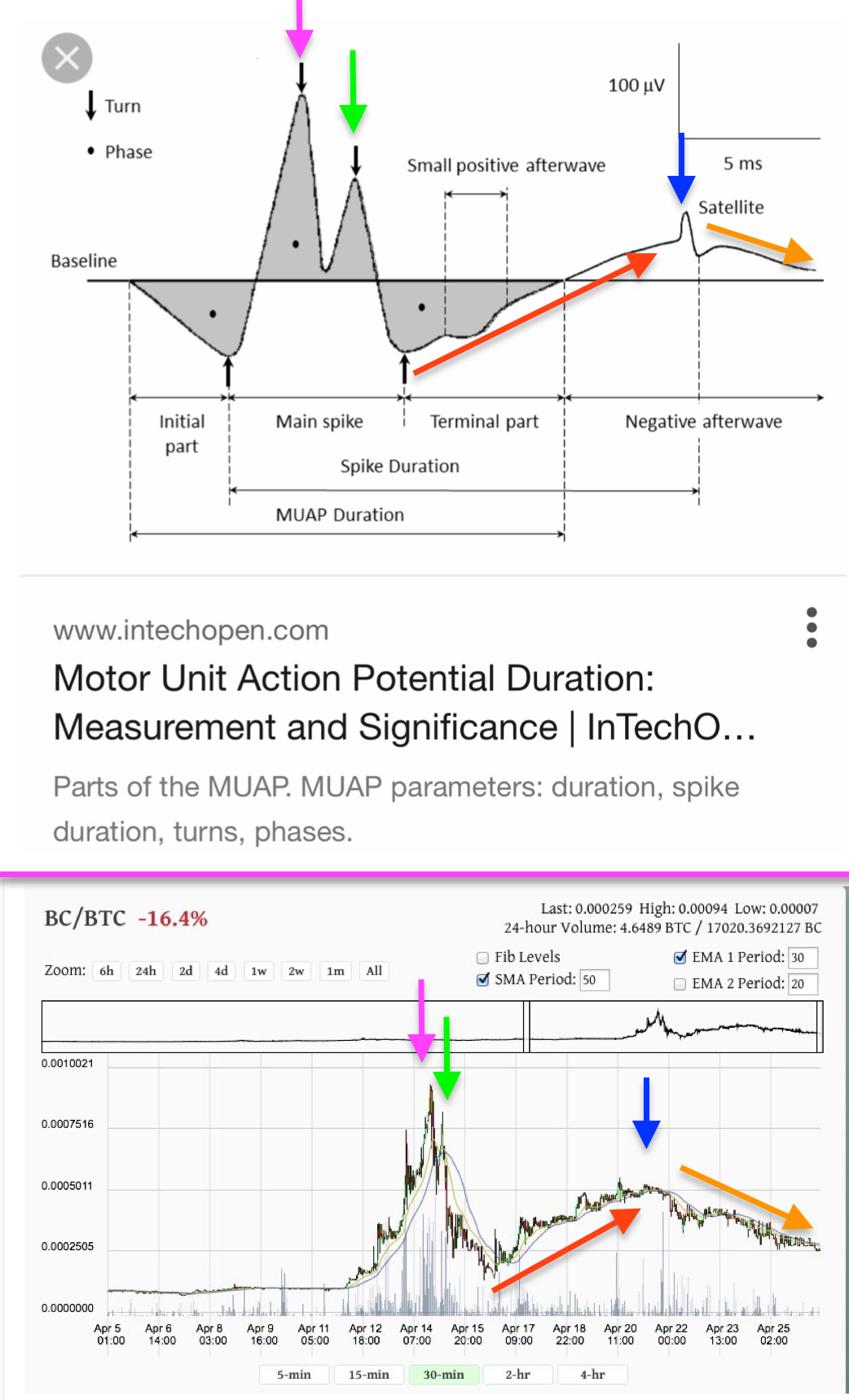

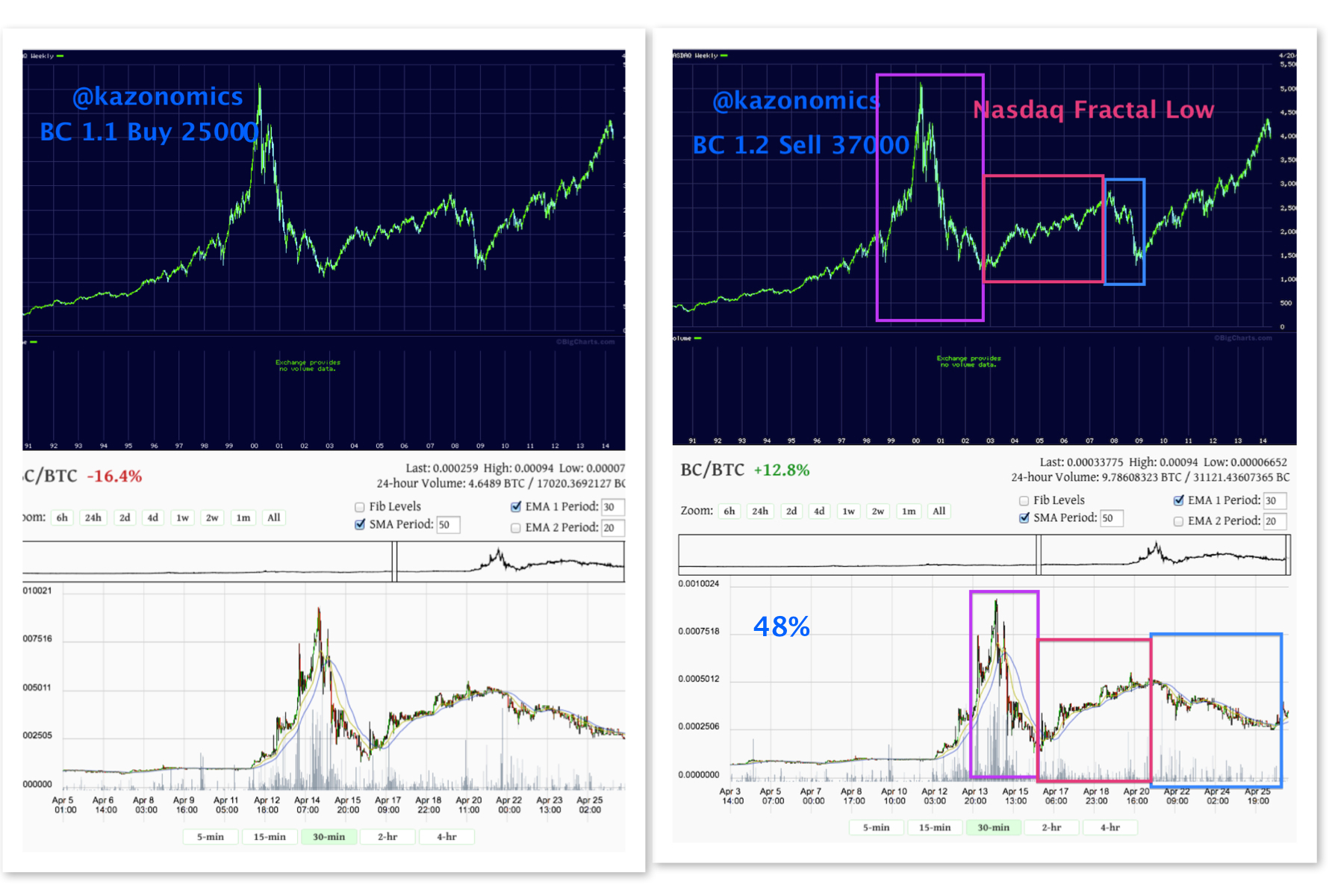

We wrote a blog post in the fall, Truth of BTC (Episode 1: Fractals) , on fractals in markets as I refined the practical application of the model on small cap crypto assets. Crash cycles had always been viewed on macro scales at this point but the reality is if the universe is indeed fractal then scale is totally irrelevant. Crypto provided a hell of a testing ground 4 this idea as the market is pretty much one of if not the most uneducated market places I’ver seen in 20 + years of trading capital markets. So saying crypto peeps are emotional is an understatement. This pattern could be seen from Blackcoin in just 2 weeks time… Even at a resolution as small as a day in a shitcoin no one gave 2 fucks about like Piggy Coin it was clearly present. The simple truth could not be avoided 😇👉Human behavior is fractal in all markets & at all scales of time. It is not a graph of fundamentals but rather a consensus of what all the participants in that system believe they know about the fundamentals as time progresses. It doesn’t matter the asset class either, 100 dummies looks exactly the same on a chart as 1 million dummies 😁👉 #Fractal Facts Bch 😋

Even at a resolution as small as a day in a shitcoin no one gave 2 fucks about like Piggy Coin it was clearly present. The simple truth could not be avoided 😇👉Human behavior is fractal in all markets & at all scales of time. It is not a graph of fundamentals but rather a consensus of what all the participants in that system believe they know about the fundamentals as time progresses. It doesn’t matter the asset class either, 100 dummies looks exactly the same on a chart as 1 million dummies 😁👉 #Fractal Facts Bch 😋

I mean does it even matter if it is even a market place? Nah not really like I said u live in a fractal universe which has a rule structure more in line with a computer program than the random chaos you were lead 2 believe. Shortly after Blackcoin we discovered the same structure in the motor action unit potential & u can even see the fake out at the blue arrow before they dumped on noobs 😂… That living in a fractal universe is prolly starting to sink in a bit now huh? Lol yah its pretty crazy when u see how organized it all really is.

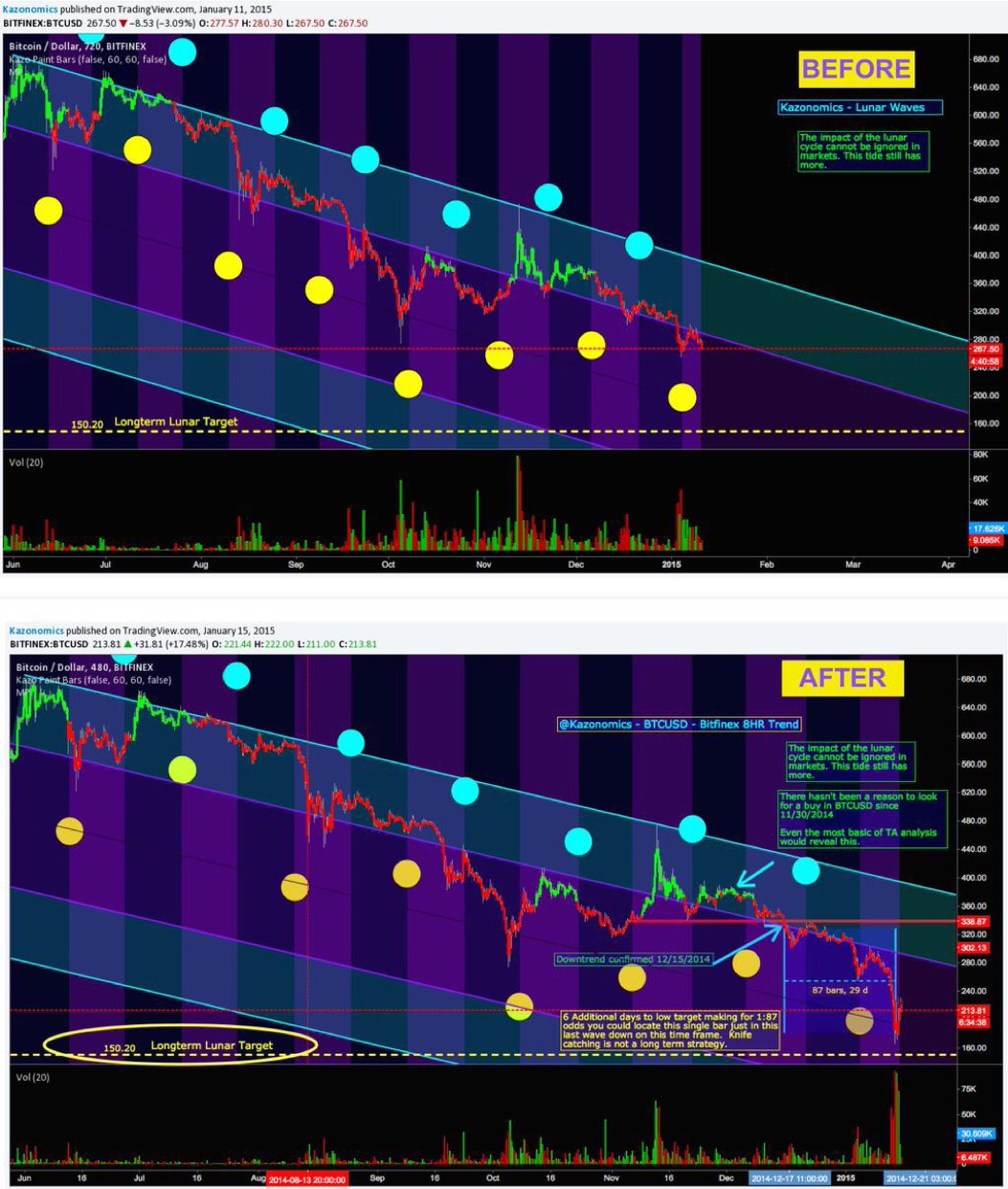

The March 2014 Bitcoin Crash Cycle chart was the 1st surgical application of this method the market had ever seen but it would have 2 see it play out 1st before they actually took it seriously & of course after much bloodshed. There’s an old saying I like it goes “A hard head will make 4 a soft ass” – crypto 2015 & 2018 both got that message the hard way 🙄

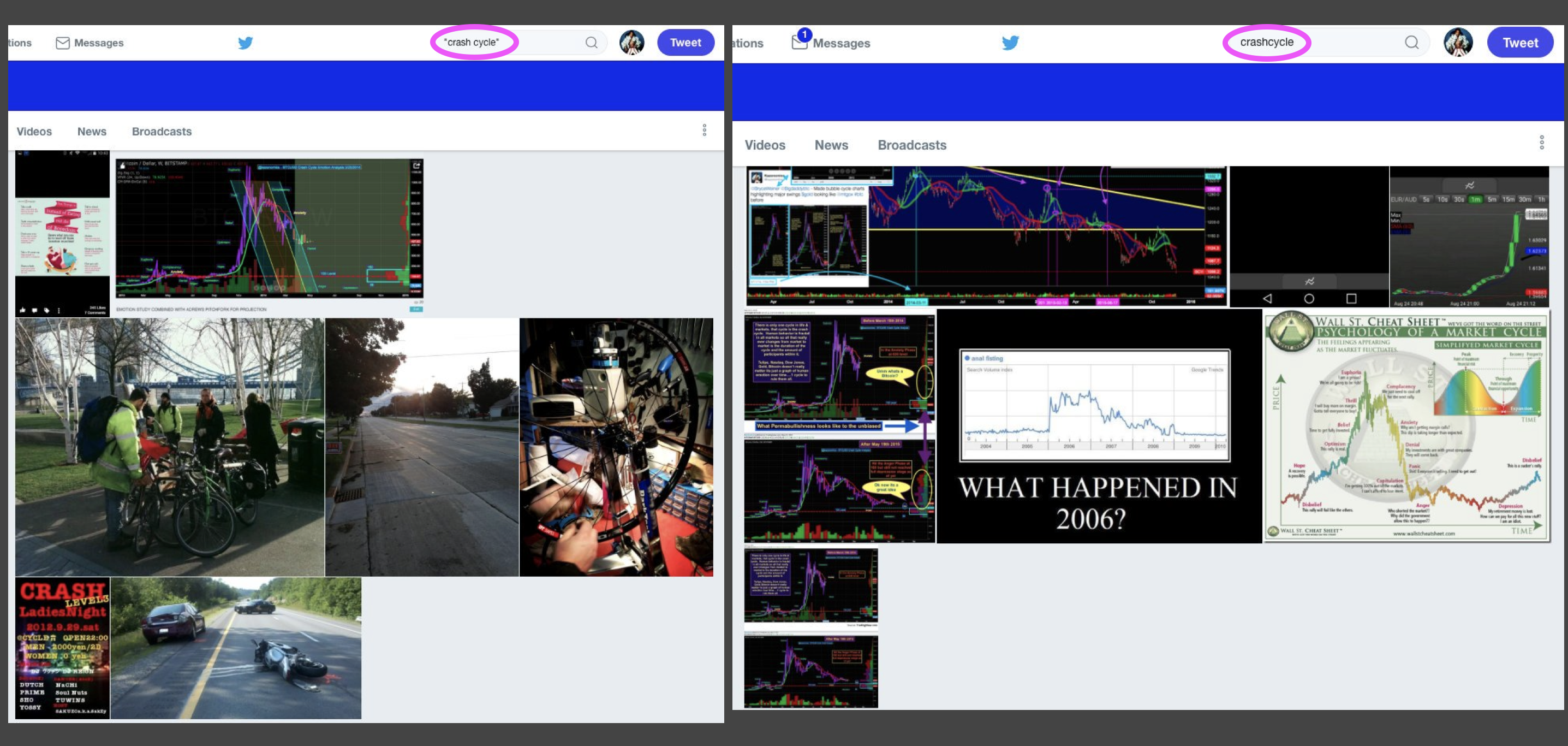

There it was the Bitcoin bear market of 2014-2015 that supposedly no one saw coming 🙃 wrong…As they say necessity is the mother of invention or in crypto’s case theft. Soon fractals & crash cycles became the normal talk of the day & has continued to present. It was actually pretty funny but looking up “crash cycle” or #crashcycle pretty much only pulled but dudes getting rekt on bicycles till Bitcoin got rekt in 2014 😂

Now you have 2 realize that humans are a part of nature and that means that the behavior we see on charts exist everywhere else too on or off the charts. Sounds pretty crazy doesn’t it but the reality is ur living inside the Matrix already 😱… no NEO isn’t gonna save u but the weatherman might 😎👍

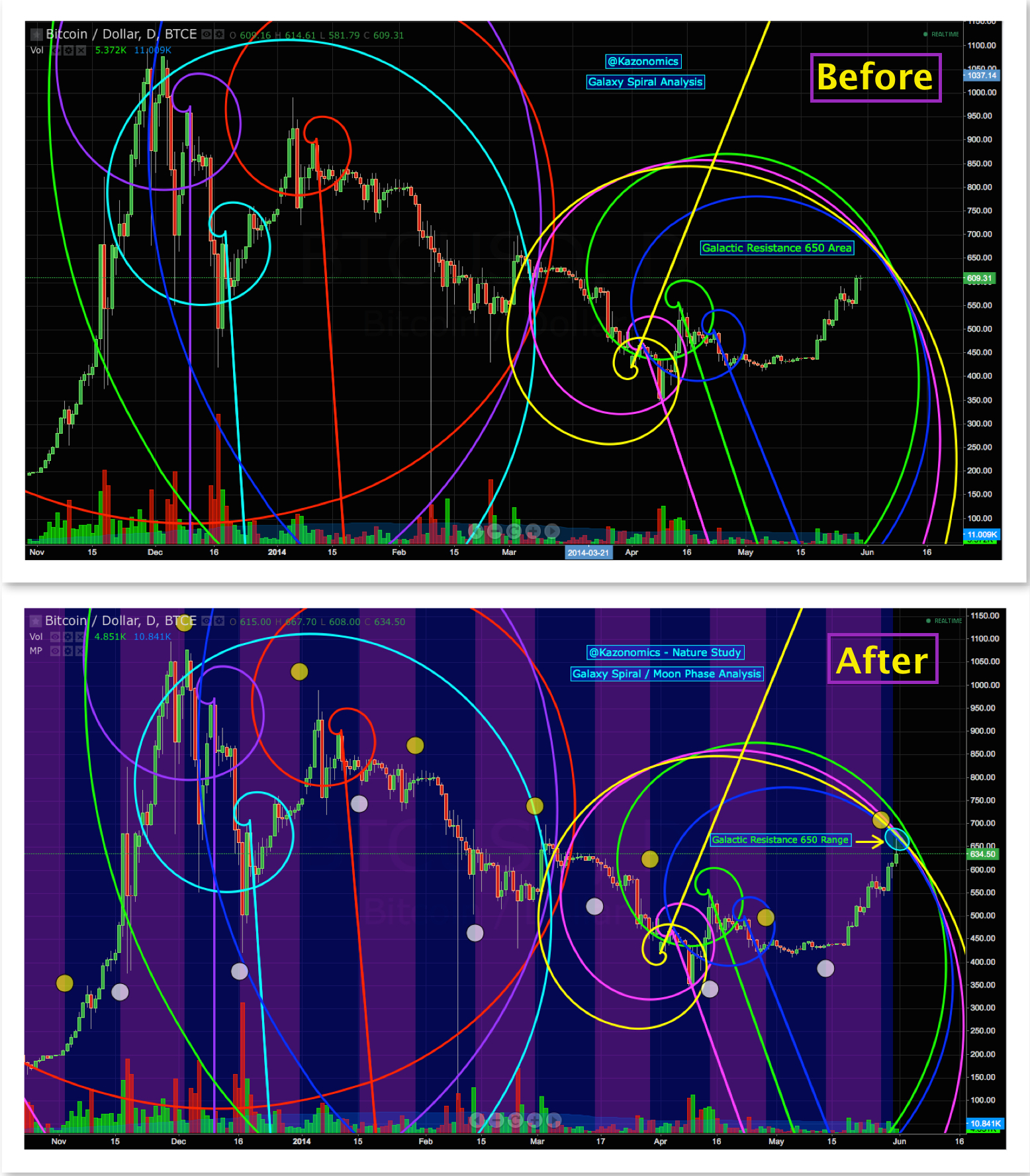

That being said if we exist in a fractal universe then all its wonders likely exist on the chart 2. So throw a little Galaxy Spiral action on that bch 2 figure out where the high of the summer was gonna be & some lunar timing 2 target the crash range lows on the Bitcoin Crash Cycle Chart & the bottom of BTC’s 2015 bear market was in. The troll level pretty much went 1000 + after these hit the twitter sphere but the market doesn’t care if you believe in it or not. The old saying markets can say irrational longer than you can stay solvent was most likely said by someone quite irrational. The universe is mathematically precise so its the one thing that is not irrational. Humans can stay irrational longer than they can remain solvent is the actual issue but not being able 2 admit your wrong is just ego…#perception of value issues 🌜🌀🌛

If you were ever wondering where moon & fib traders came from in crypto 🤔….now u know. Sure peeps might have put it on a chart once or twice 4 shits & giggles but using it with actual precision, I mean do you really need a separate blog post 4 that? 😉

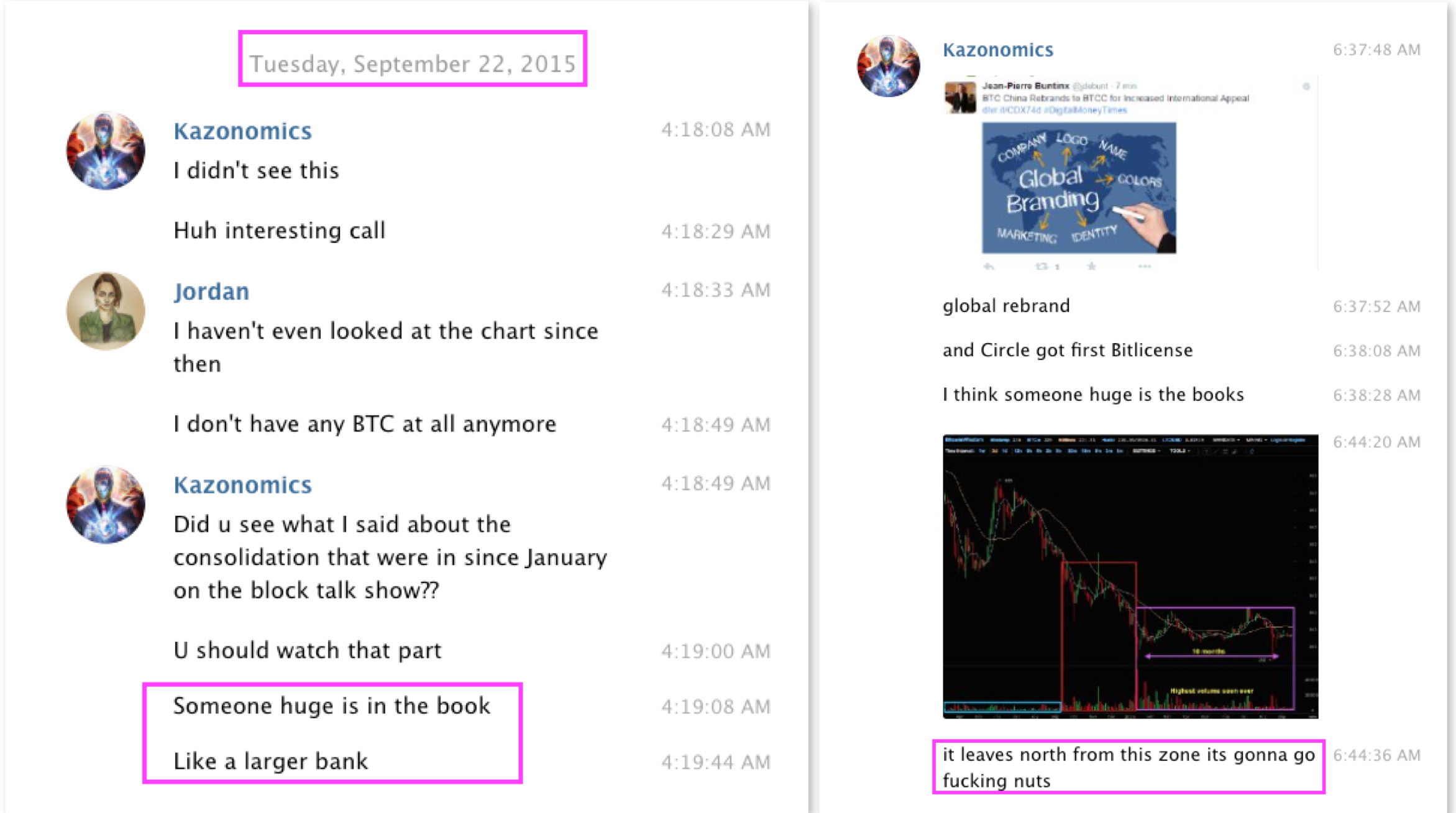

Summer of 2015 we detected a more sophisticated algo in the order books which gave away the presence of a large institution in the order books at the lows of the market. Could it be time for another cycle in Bitcoin already? Yes it could & with targets met from the Bitcoin Crash Cycle chart of 2014 that was what seemed likely 2 be coming next.

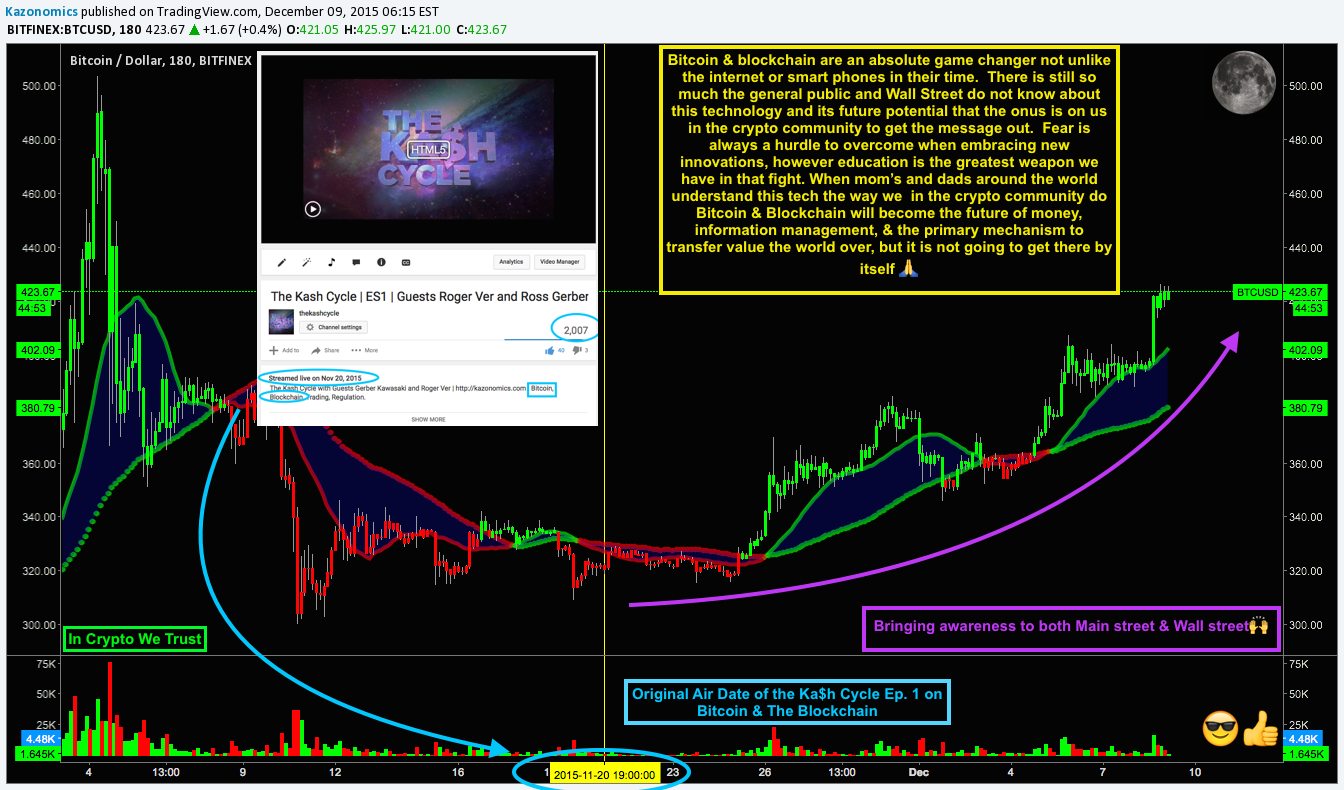

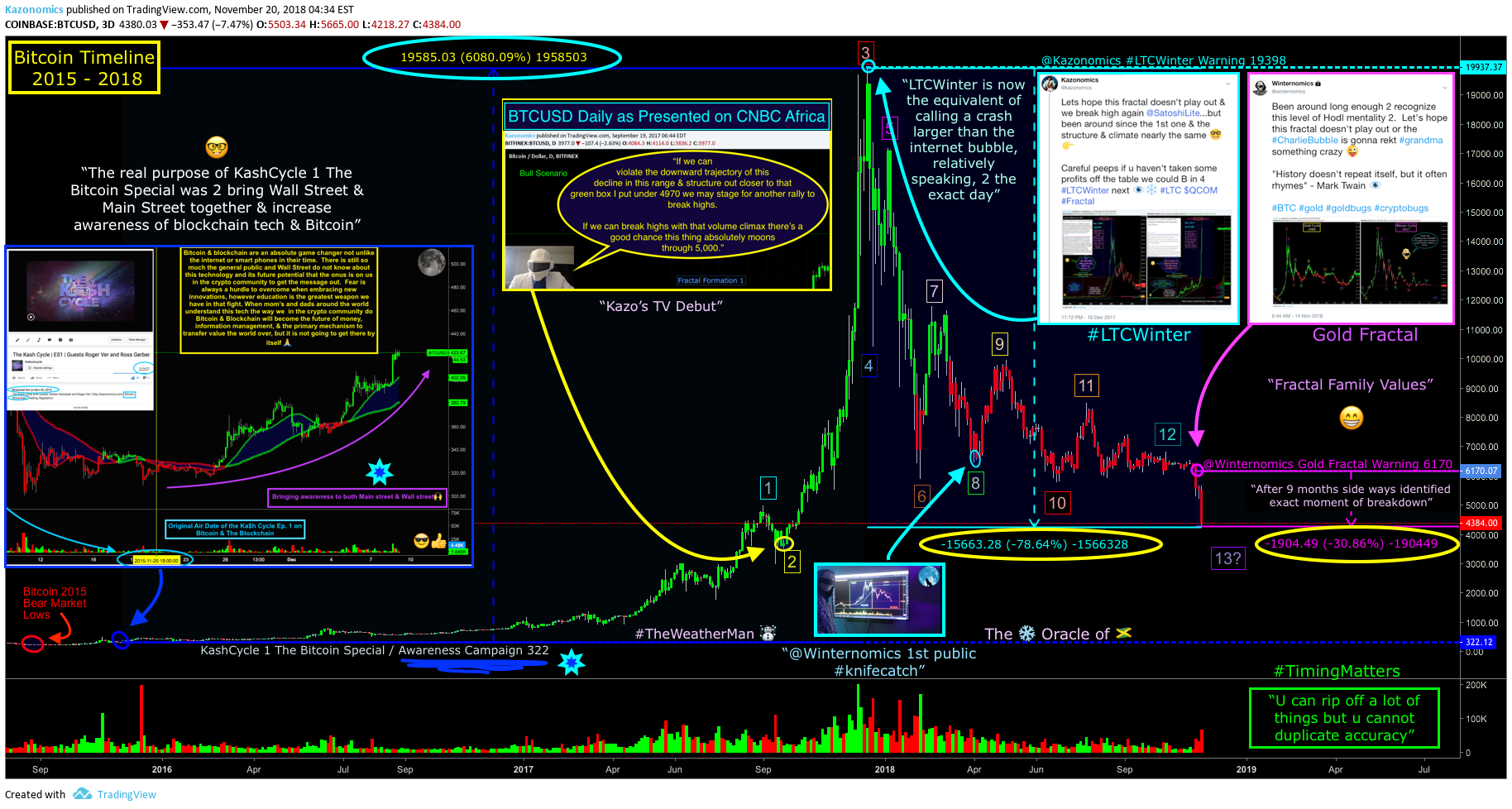

Shortly after this we met legendary investor Ross Gerber @gerberkawasaki & had an opportunity to introduce Bitcoin 2 Wall Street in a sit down with Bitcoin Jesus aka @rogerkver 😈👉 Kash Cycle 1: The Bitcoin Special was born & dubbed the awareness campaign on Nov 20th 2015. The show was a 1st of its kind round table between Wall Street & Crypto designed to inform both Wall Street & Main Street about the future of blockchain & Bitcoin in the 🌍 ( Go easy on us it was our 1st try & we planned & made that show in 3 days 😇)

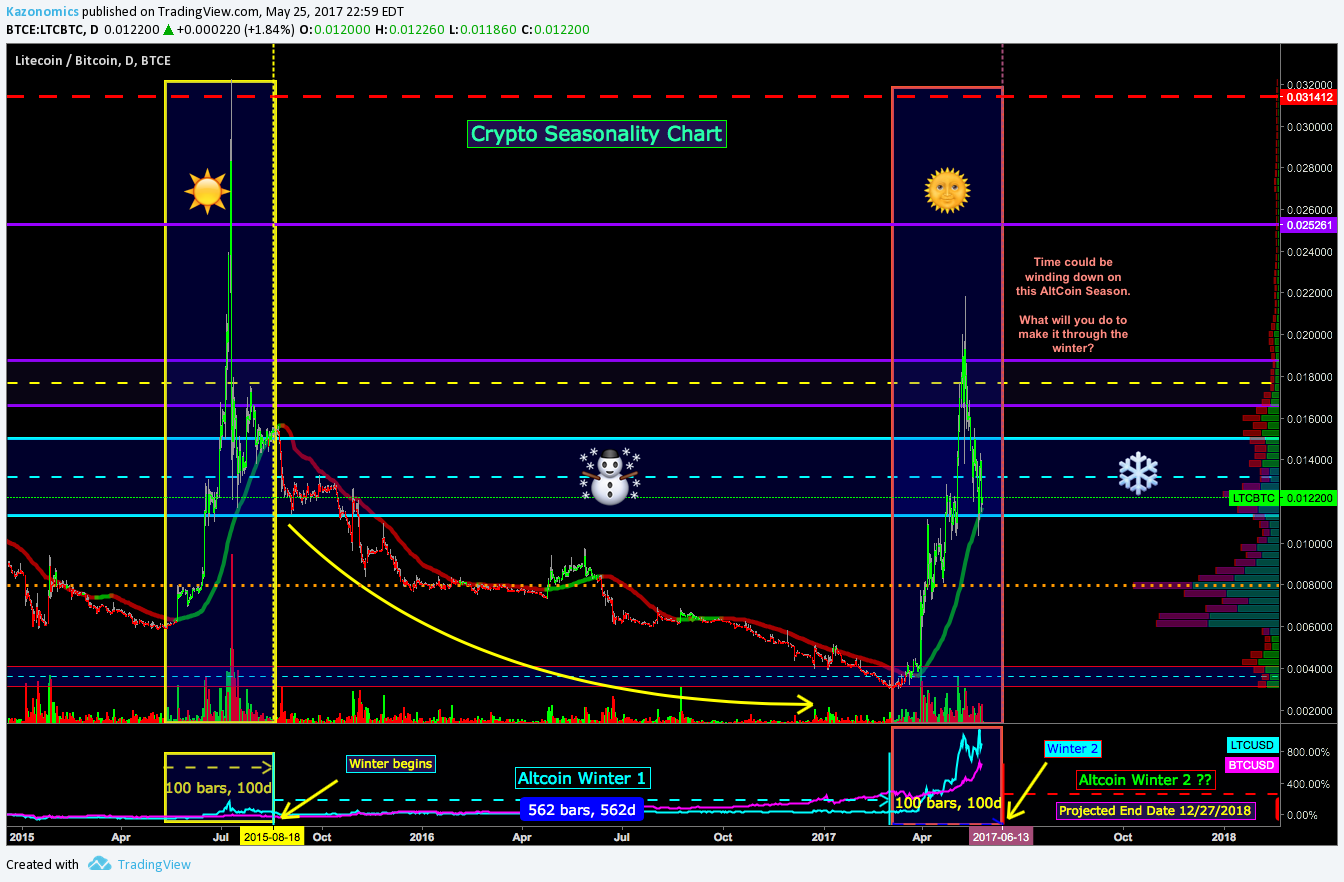

May 25th 2017 we noticed a familiar intramarket behavior that gave away what was to come for the entire crypto market as a whole. Humans are subject to repeating behaviors over time this is the reason for the cyclicality of all markets so we dropped the Crypto Seasonality chart which predicted the end of what would become a very brutal winter cycle the end date of which would be December 27th 2018 some 18 months in the future 😉👉🔮

Sept 2017 we had our global TV debut in the financial 🌎 with our appearance on Cnbc Africa’s show CryptoTrader. On that show we gave an easy to follow play book for what was to come for both Bitcoin & Ethereum 🔮

We all know how this story ended in 2017 but along the way we would find so many more interesting opportunities to use fractal logic. In the summer of 2017 Bitcoin Jesus & Jihan Wu @jihanwu were able to get a enough miners on board 2 fork Bitcoin & Bitcoin Cash was born. There were some incredible similarities in the summer of 2017 with the summer of 2015 & it was super obvious with twitter Og’s trolling the shit out of Roger the guy who literally saved Bitcoin in 2015… that might be up 4 debate with many but only 4 those without all the intel….And those same many didn’t get any calls right about anything in the market so we don’t debate dummies or only u makes u look like a fool. Anyway went ahead & made the call on twitter & got Insta-trolled by same dummies from summer 2015. When that #dumbmoney indicator pops up u know its game on bch’s lol & BOOM Insta-rekt every Og troll hating on BCH & Bitcoin Jesus 😂… Can u image crypto plebs got 2 chances at the exact same play but were too salty 4 either one when it mattered. Facts suck but reality is what it is value is scarce in markets & life 🔮#BCH Pls 🔮

We all know how this story ended in 2017 but along the way we would find so many more interesting opportunities to use fractal logic. In the summer of 2017 Bitcoin Jesus & Jihan Wu @jihanwu were able to get a enough miners on board 2 fork Bitcoin & Bitcoin Cash was born. There were some incredible similarities in the summer of 2017 with the summer of 2015 & it was super obvious with twitter Og’s trolling the shit out of Roger the guy who literally saved Bitcoin in 2015… that might be up 4 debate with many but only 4 those without all the intel….And those same many didn’t get any calls right about anything in the market so we don’t debate dummies or only u makes u look like a fool. Anyway went ahead & made the call on twitter & got Insta-trolled by same dummies from summer 2015. When that #dumbmoney indicator pops up u know its game on bch’s lol & BOOM Insta-rekt every Og troll hating on BCH & Bitcoin Jesus 😂… Can u image crypto plebs got 2 chances at the exact same play but were too salty 4 either one when it mattered. Facts suck but reality is what it is value is scarce in markets & life 🔮#BCH Pls 🔮

Going into November yet again we would have another meeting of the minds in Kash Cycle 3: The Real Bitcoin with @gerberkawasaki & @rogerkver Almost 2 years 2 the day from Kash Cycle 1 enter Nov 21st 2017. Many love 2 talk about coincidences but in reality there is no such thing in a mathematically precise universe only synchronicity…That is very important 2 accept as many do not. If you think out timing Buffet twice & nailing Bitcoin & Bitcoin Cash in 2 separate years in the exact fractal structure is all coincidence then you been done heavier drugs than my ass bch 😆🖕

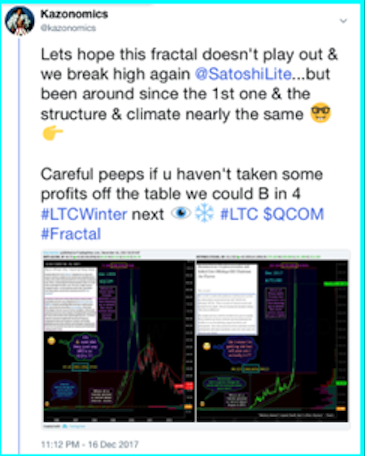

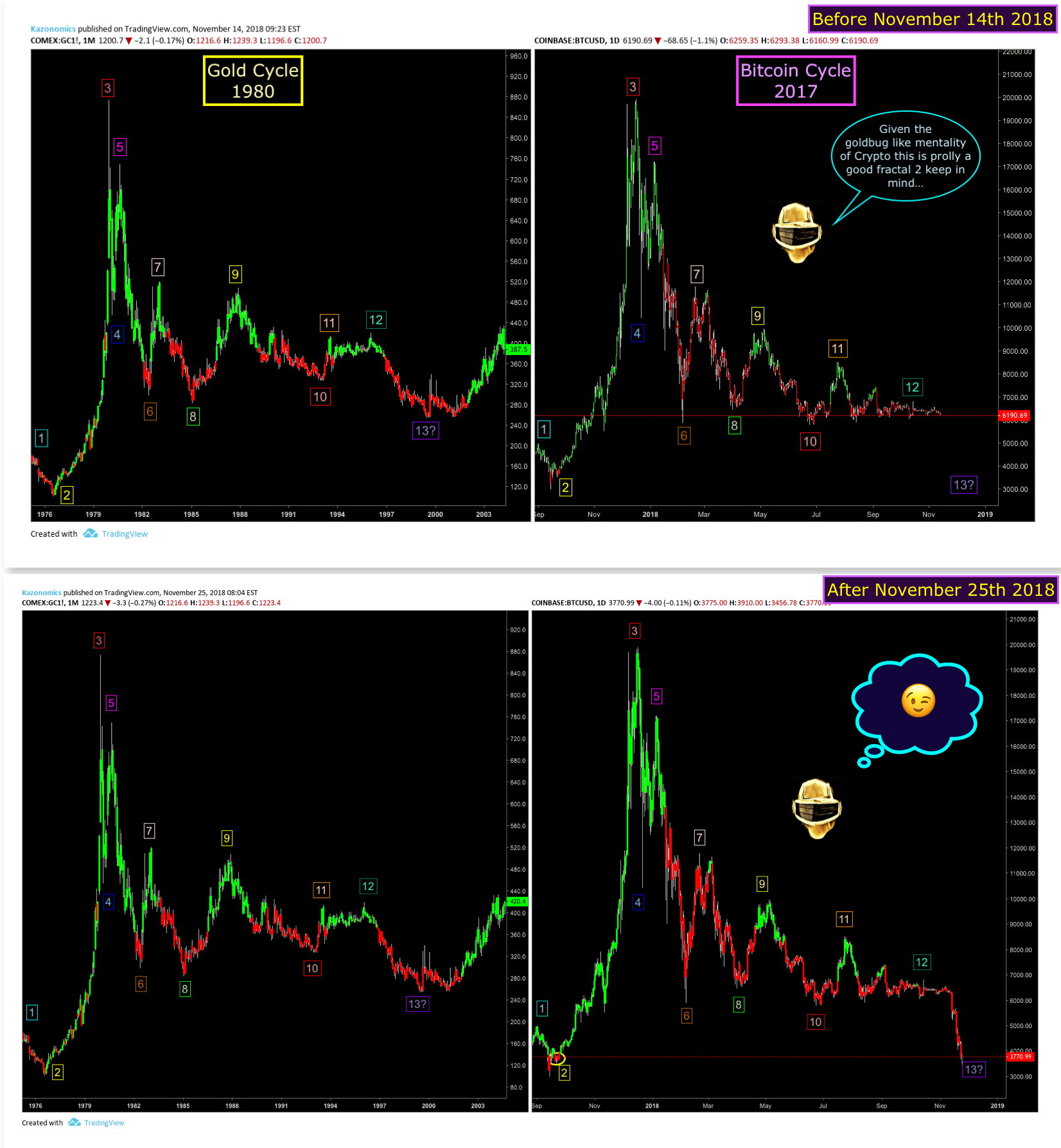

Unfortunately all this moon pumping got to members of Wall Street who made it their focus 2 separate crypto plebs from their winnings. Haters are always gonna hate & it always looks the same, cuz lets face it most don’t really want 2 see others succeed or at least not do better than themselves & this isn’t any less true of a typical crypto plebs than it is 4 say someone of Jamie Dimon’s stature…. I am not saying he is the specific party that was just 4 examples sake. Anyway we issued countless warning 4 what it would mean 4 the CME Bitcoin Futures Cash Settled contracts to enter the market & it was not gonna be good thing as plebs had imagined it should be. Many equated the CME with institutional money entering the market but in reality the futures product was cash settled & introduced with the specific purpose of reigning in what Wall Street considered a run away market / Ponzi scheme. Sadly they were not far off on this belief as the old market had given way 2 greed on levels not seen since the internet bubble of the dot com era in late 90’s. Funny enough that was actually the exact mood of the market on the night of December 16th 2017. Can u imagine some e-pen sucking pleb with a 9 to 5 thinking that billionaires were gonna buy their bags off them at worse prices than they got ffs #dumbmoney doesn’t know its fucking #dumb. Having been through the internet crash cycle myself In my late teens & early 20’s I was able 2 recognized the tell tale signs of the excesses of crypto & proceeded to try & warn the market which much like March 2014 warning did not get recieved very well either as Og Fud helped 2 hide the analysis from everyone & ultimately killed them all 🤐👉 Enter #LTCwinter or #CharlieBubble ❄️❄️❄️

The #LTCwinter market prediction is the equivalent of calling the end of the internet bubble 2 the day & a larger collapse in scale when compared on a relative basis. Many like 2 keep saying no one knew this was coming but many also can’t admit they are totally full 💩 either & will transfer their short comings 2 others as a way 2 safeguard their ego 🤓👉Thats ur typical crypto OG or Wall Street analysts that calls the same thing wrong over & over & in the face of overwhelming evidence they are incorrect remain steadfast in their belief usually causing fantastic damage to themselves & anyone else unfortunate enough 2 hear those cuck’s uneducated bull 💩

The #CharlieBubble or #LTCwinter has been an amazing opportunity 2 study the behaviors of the humans that make up the charts we see as it unfolds. I wasn’t sure wtf was going in 1999 but fool once mother fucker…what did George Bush Jr. say? Well whatever u can’t fool me again bch we seen this movie before 🤣🤣🤣. What did they tell you again Charlie did it 4 the people right lmao…right 🤤

Even with a detail analysis such as this heavy bias made it invisible to the market market place as greed overcame reason & HODL train rekt unfolded into 2018. The reality is HODL can make u look smart until it doesn’t & when it doesn’t there is no hiding place for anyone using it. When peeps make money they are sure its their fault but when markets go against them u quickly see them externalize all responsibility 4 the losses. When you see this that is #dumbmoney a persons that is too immature 2 be in markets & uses the rational of a child whom are also very good at avoiding taking any responsibility for their actions 2….I’m a daddy trust me deal with it daily #fractal behavior in children or adults. After all we are adults are really just fractals of their childhood selves anyway.

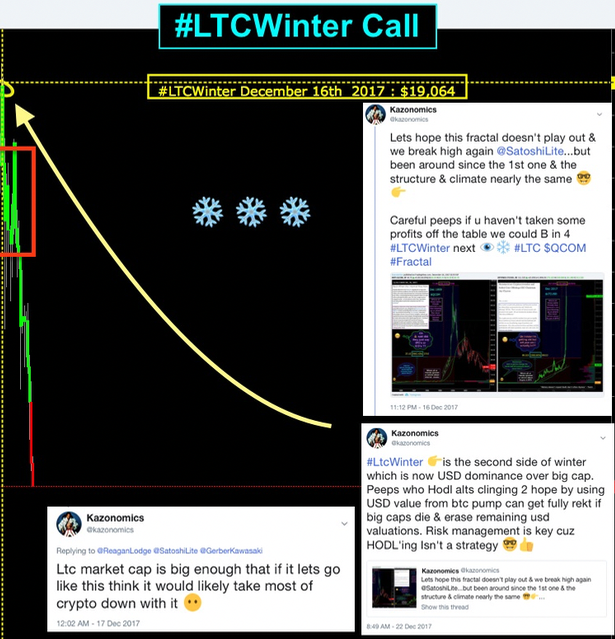

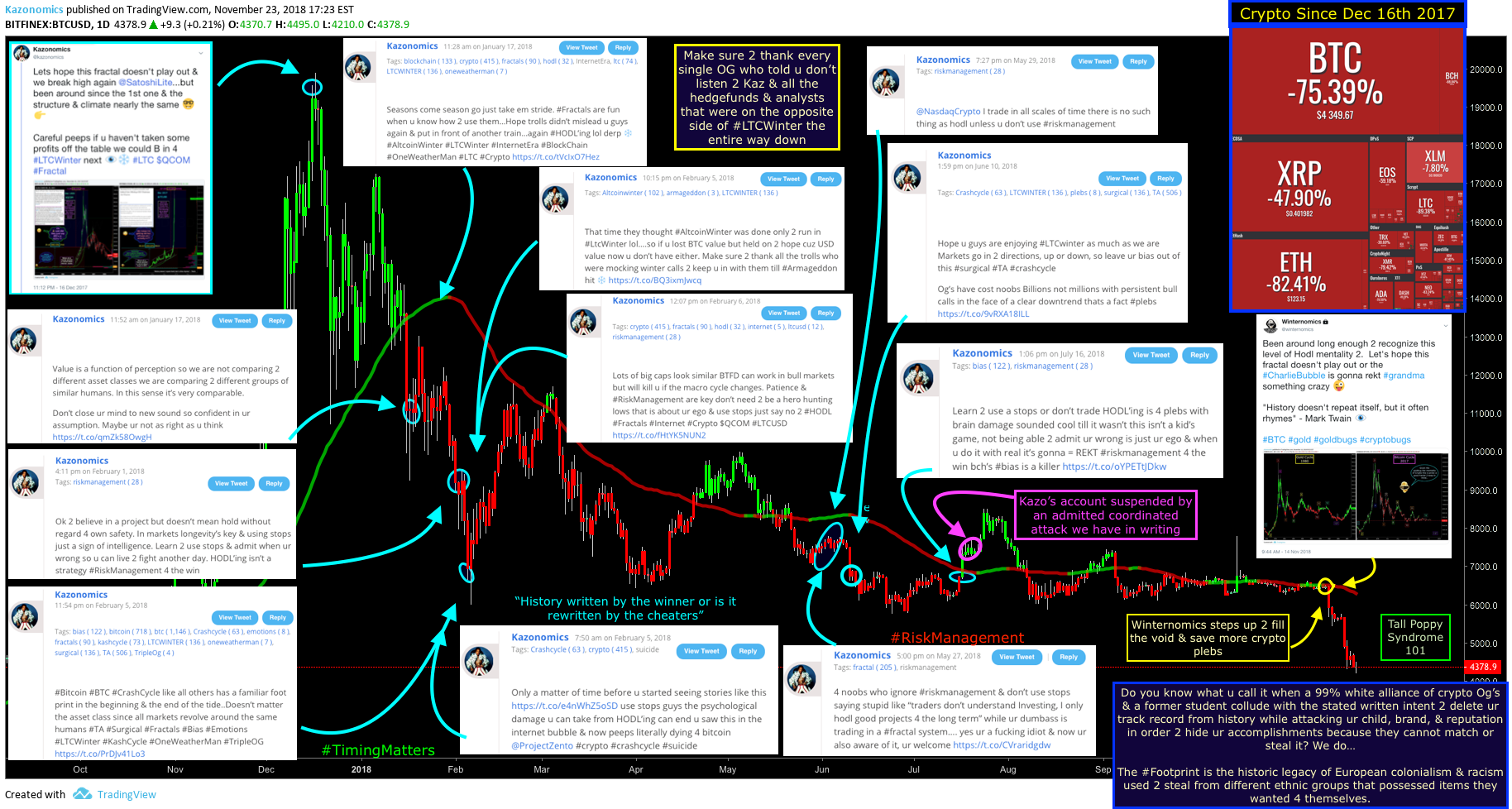

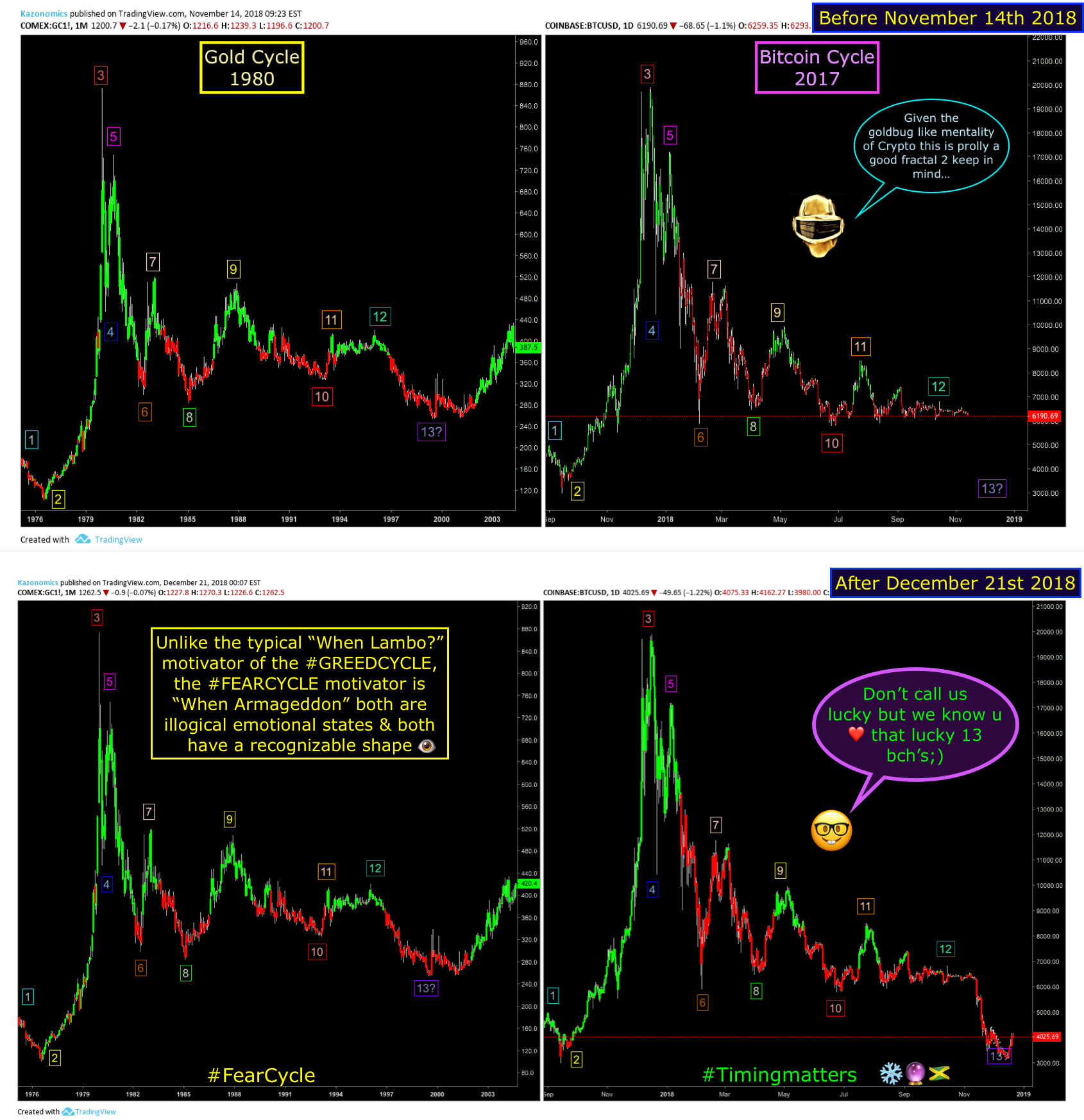

The internet bubble Crash Cycle fractal is definitely a fun one to watch unfold in so many markets on so many scales but as we always said value is scarce and when it becomes too obvious well time 2 move on. Enter the #GoldCycle or the Mega Hodl Cycle. You got Bitcoin Maximalist & Shitcoin Maximalist these 2 are not the same. The mentality of shitcoin traders is what was like the internet bubble. Internet bubble was dominated by greed much like the end of 2017. However belief structures around Gold are driven by irrational fear of debt, central banks, & the end of the 🌍. These people are hashtag fucking crazy because they are willing to overlook any and all logic 2 cling 2 their belief much like a religious nut job. If you recall at the top of this post we introduced crash cycles in 2014 with the current state of Gold & Btc at the time, remember that “Digital Gold” thingy welp so did we however the most fearful era of gold was not the current 🌍 we live in but one only us dinosaurs remember & that was the Cold War era of the 1980’s that followed the stagflation & oil crisis of the 1970’s. Peeps calling the end of the 🌍 is as old as time but if u really thought about it, its not really worth ur time 2 do. If u get that call right guess what? WE ARE ALL FUCKED AND IT WON’T FUCKING MATTER…. I mean be serious do peeps think after the apocalypse your gonna go buy like some groceries with a block of GOLD? Wtf are u gonna do ask someone for some change 4 your gold bar during the apocalypse when u buy some fucking Cheetos snacks?? If people see you have some 💩 like that they are just gonna kill ur ass & take the fucking gold so stfu with that bulllshit already its fucking dumb & ur only gonna get the call right once… You might be on some spiritual awakenings bs or something but wtf ever u do don’t invest ur money based on that dumb 💩 or only rekt is in ur future 🔮 & if ur gonna do it anyway then 4 god’s sakes keep that garbage 2 urself or ur gonna get rekt & take the entire market down with u whew!!

**Updated Below Added: Dec 30 2018**

We have seen here is the 1st ever compound fractal of both Greed & Fear cycles in the same market at the same time. No not a compound FullCum from some old ass Pleb nope this is actually some real 💩 lol. Bitcoin exhibited the Gold Fear Cycle of the 1980’s-1990’s while simultaneously its shitcoin derivative market was experiencing the Internet Bubble Greed Cycle. With #LTCwinter crashing shitcoin markets 90% & then the #GoldCycle taking the entire ecosystem down 80% you have a compound fractal that rekt shitcoin bag holder’s for 98 % of their value while they HODL into the grave like morons lead 2 the slaughter by Pantera, Novagratz, insider trading frauds, & plebs all singing the same tune. The Crypto Crash of 2018 will go down in history as one of the worst crashes of all times relatively speaking. There were no shortage of warning the reality is people see what they want to see regardless of whats starring them in the face. Bear markets don’t end in a single bounce they end with mass graves ☠️☠️☠️

We have seen here is the 1st ever compound fractal of both Greed & Fear cycles in the same market at the same time. No not a compound FullCum from some old ass Pleb nope this is actually some real 💩 lol. Bitcoin exhibited the Gold Fear Cycle of the 1980’s-1990’s while simultaneously its shitcoin derivative market was experiencing the Internet Bubble Greed Cycle. With #LTCwinter crashing shitcoin markets 90% & then the #GoldCycle taking the entire ecosystem down 80% you have a compound fractal that rekt shitcoin bag holder’s for 98 % of their value while they HODL into the grave like morons lead 2 the slaughter by Pantera, Novagratz, insider trading frauds, & plebs all singing the same tune. The Crypto Crash of 2018 will go down in history as one of the worst crashes of all times relatively speaking. There were no shortage of warning the reality is people see what they want to see regardless of whats starring them in the face. Bear markets don’t end in a single bounce they end with mass graves ☠️☠️☠️

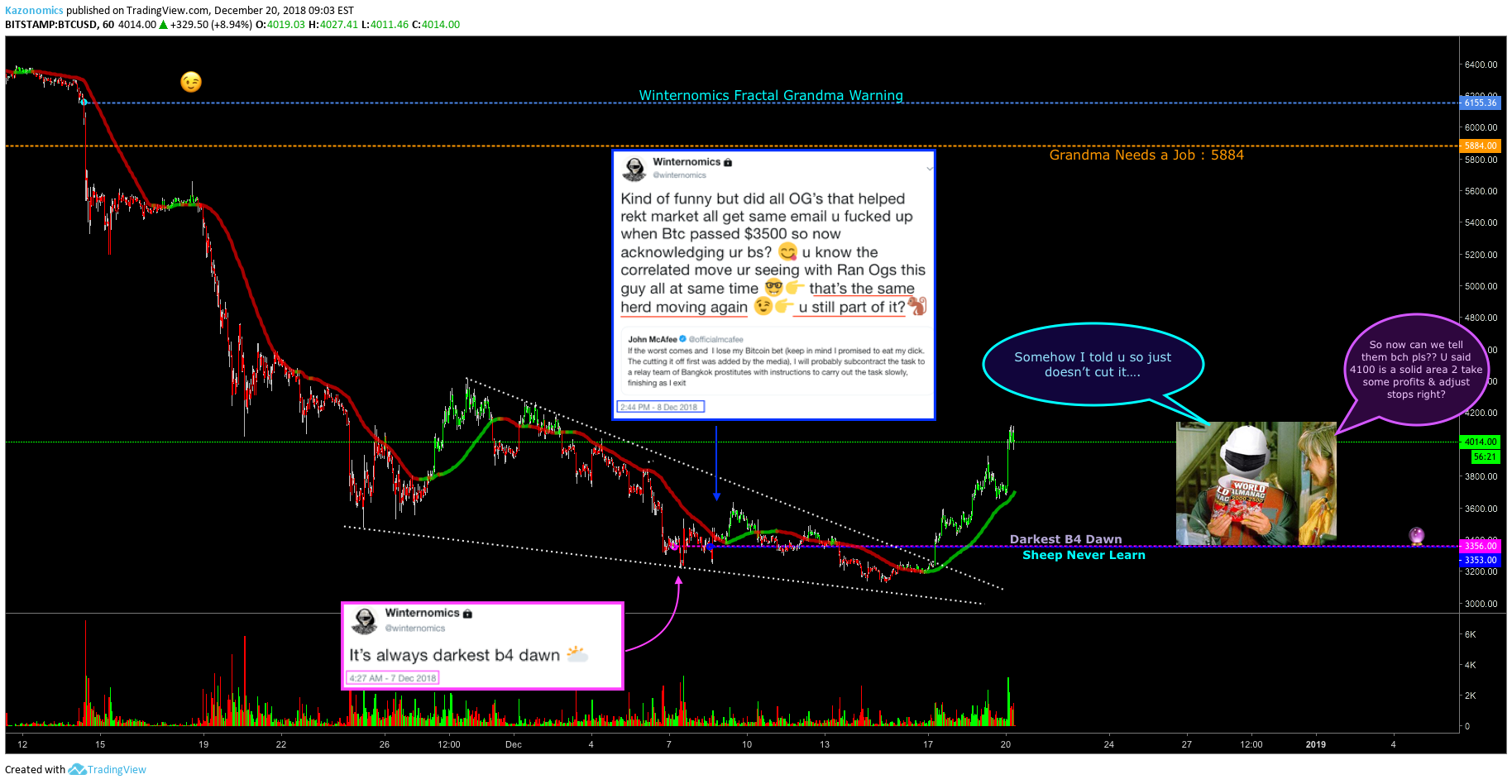

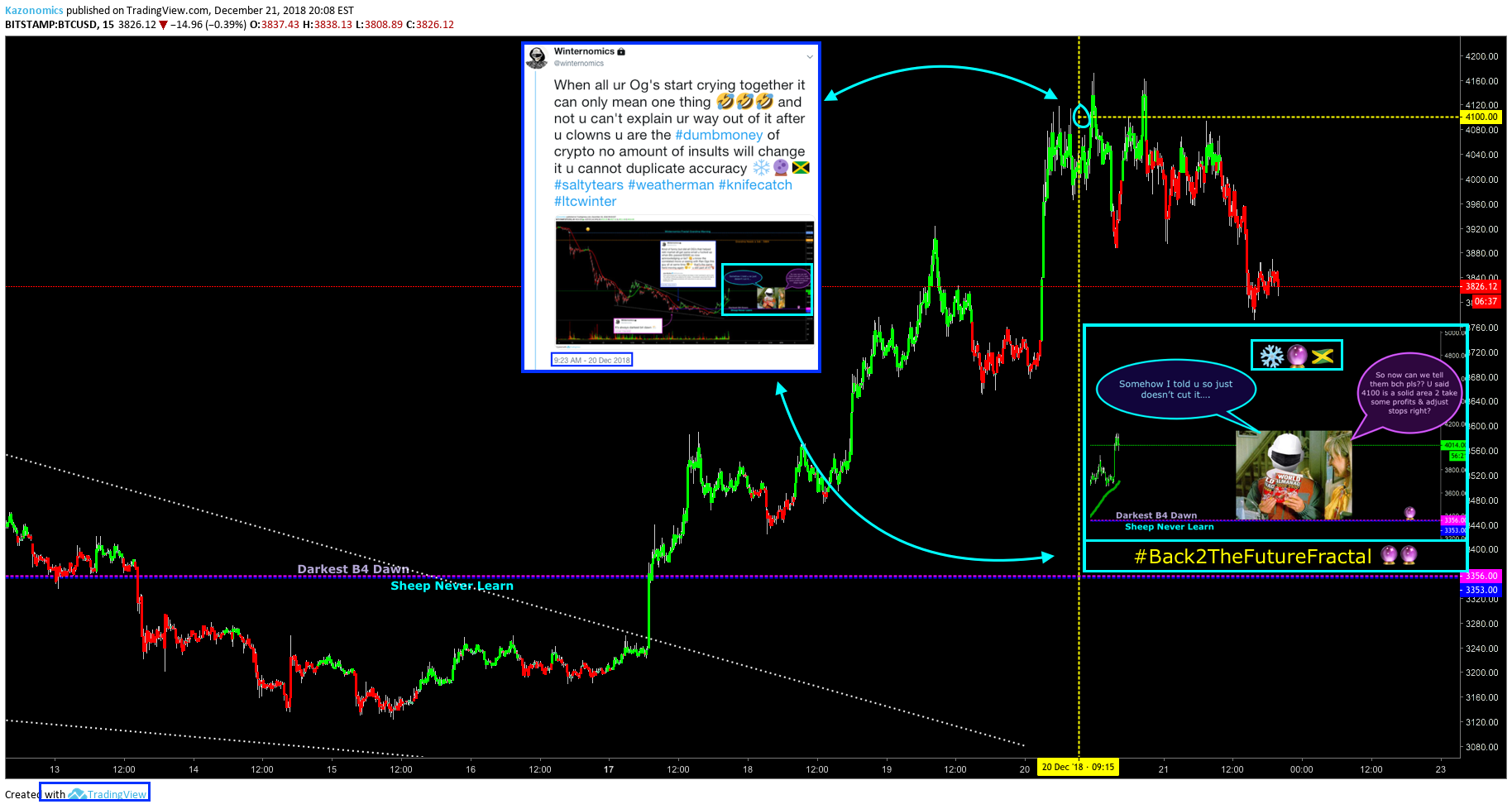

After the GOLD Fractal target “Lucky 13” hit late Nov 2018 for Bitcoin you could feel the sentiment take an even darker….enter “Darkest Before Dawn” 🌥 & the Back to the Future 🔮🔮Fractal comics series cuz you know that 4100 is a beast 😁…The Back to the Future Fractal was not a fractal based on previous prices but more of an inside joke about the Sports Almanac & future events that were to come in the prediction itself 😋

In our live twitch stream on winternomics.tv at the end of 2018 we did a show called Hunt for O.G.Tober which you can rewatch on our youtube station, it covers a lot of the sentiment and market structures that are posted in this blog as the market meltdown into the lows of 2018. Being objective means keeping proper context of markets over time & that means understanding how the crash really occurred & how so many remained convinced to HODL until their demise. When we fail to keep accurate records of history we are doomed to repeat our mistakes. The reality was the market was lead off a cliff from Fund managers to plebs that had no business advising you how to fix a ham sandwich let alone where to put ur 💰but unfortunately the crowd could not determine friend from fraud in the market place for numerous reasons. Once greed had fully taken hold it was easy to trap new comers & old with the constant cheerleading & over blown expectations for both BTC & altcoins. From the top of the market all the way down “HODL” was the single idea that dominated the space. When everyone’s got the same idea you are prolly in serious danger & u heard nothing different from Fund Manager to rookie. Herd behavior is dangerous as the majority simply cannot deal with reality & instead out of ego try to deny or even hide from any facts that might compromised sense of self & what also has really happened during Crypto Winter 2018 ❄️

In our live twitch stream on winternomics.tv at the end of 2018 we did a show called Hunt for O.G.Tober which you can rewatch on our youtube station, it covers a lot of the sentiment and market structures that are posted in this blog as the market meltdown into the lows of 2018. Being objective means keeping proper context of markets over time & that means understanding how the crash really occurred & how so many remained convinced to HODL until their demise. When we fail to keep accurate records of history we are doomed to repeat our mistakes. The reality was the market was lead off a cliff from Fund managers to plebs that had no business advising you how to fix a ham sandwich let alone where to put ur 💰but unfortunately the crowd could not determine friend from fraud in the market place for numerous reasons. Once greed had fully taken hold it was easy to trap new comers & old with the constant cheerleading & over blown expectations for both BTC & altcoins. From the top of the market all the way down “HODL” was the single idea that dominated the space. When everyone’s got the same idea you are prolly in serious danger & u heard nothing different from Fund Manager to rookie. Herd behavior is dangerous as the majority simply cannot deal with reality & instead out of ego try to deny or even hide from any facts that might compromised sense of self & what also has really happened during Crypto Winter 2018 ❄️

After nearly a year of putting people in front of a speeding train you would think maybe crypto learned something but nah that would be asking way too much. Unbelievably as we approach “Lucky 13” target in the Gold Fractal they actually reverse pretty much at dead lows & start telling peeps watch out for Winter like omfg u really can’t make this 💩 up hashtag rekt af if you kept blindly following this nonsense. Value is scarce & only had by the few so by the time crypto is down 80-90% the idea Crypto Winter is more than fully valued…

Upated May 11th 2019 (2 charts) – As it stands today the #LTCwinter or Qcom Litecoin internet bubble fractal made on December 16th 2017 & the Gold Fractal prediction for Bitcoin made in Nov 14tth 2018 combined with the forecasted end date of Winter 18 months ahead of time are the accurate predictions in all of crypto history & possible all markets ever done by any technical analyst.

#LTCwinter Update May 11th 2019

#Gold Fractal Updated May 11th 2019

If anyone else tells u they are the Fractal King feel free 2 spoon feed them a healthy dose of #Bchpudding 😜 In the world of technical analysis there is only one Weatherman only one ❄️ Oracle of 🇯🇲 accept no substitutes that 💩 is bad 4 ur health. Peeps are always gonna try 2 steal a lot of things but one thing they will never duplicate is accuracy. We have chronicled it all in the TA Comic series over the year & it been an incredible learning experience 2 watch the the interwoven fractal cycles of fear & greed unfold over time. Human behavior is fractal in all systems & all time frames 👁

” History doesn’t repeat itself, but it often rhymes”

🔮Mark Twain 🔮