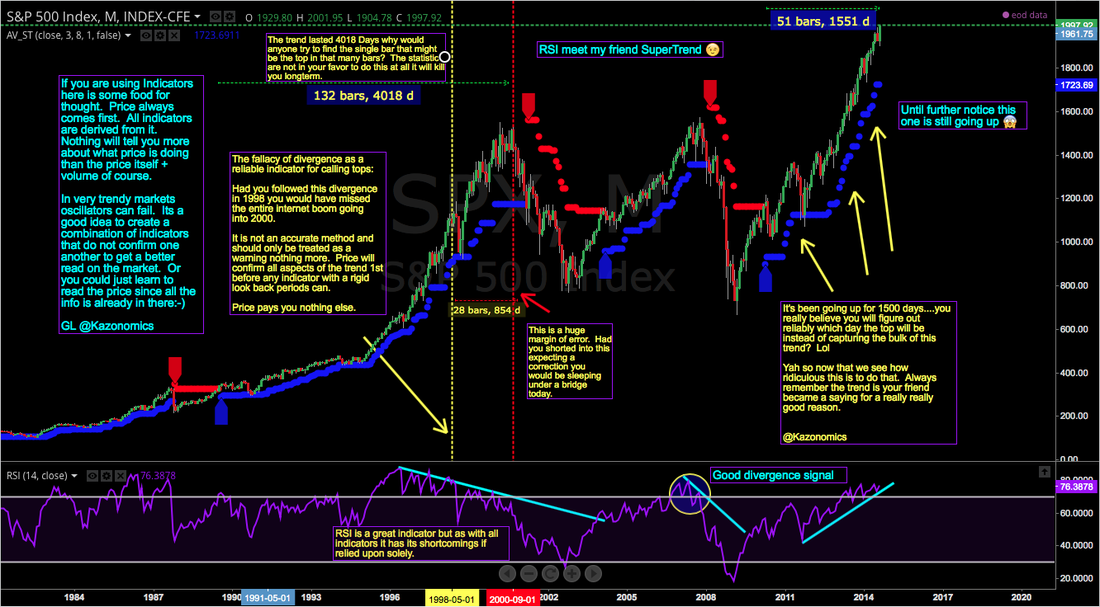

Divergence or Not Divergence?

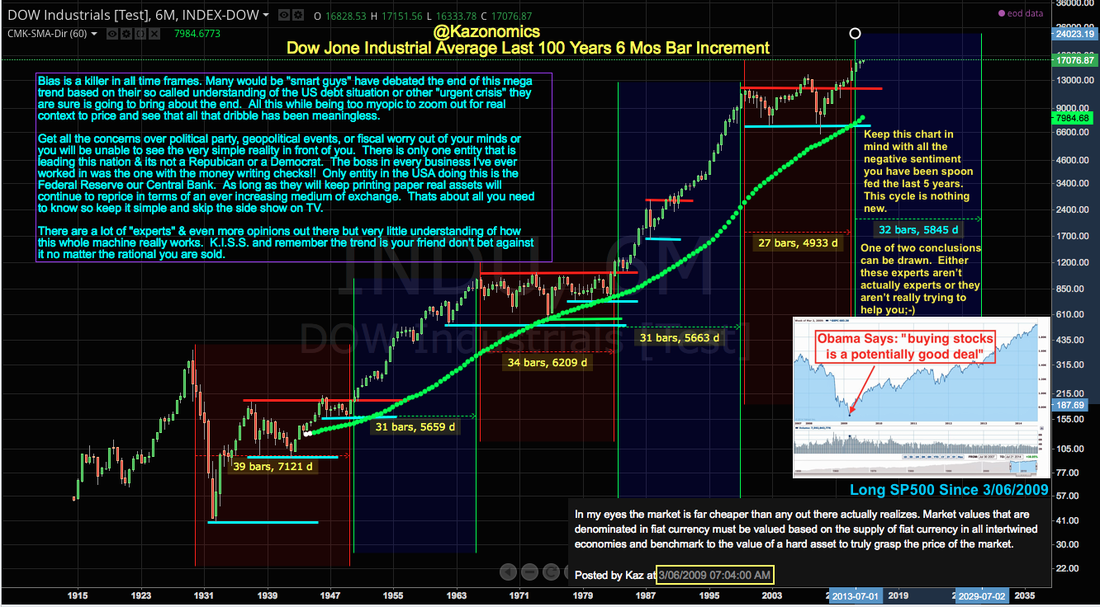

Relying on a single indicator can be very dangerous in trading. Many treat indicator divergence as the holy grail in identifying tops or bottoms. Having a bias can be lethal to your longterm trading career as in anything else. Its always best to create combinations of indicators that can highlight different aspects of the […]